Record-breaking feat in declining smartphone market

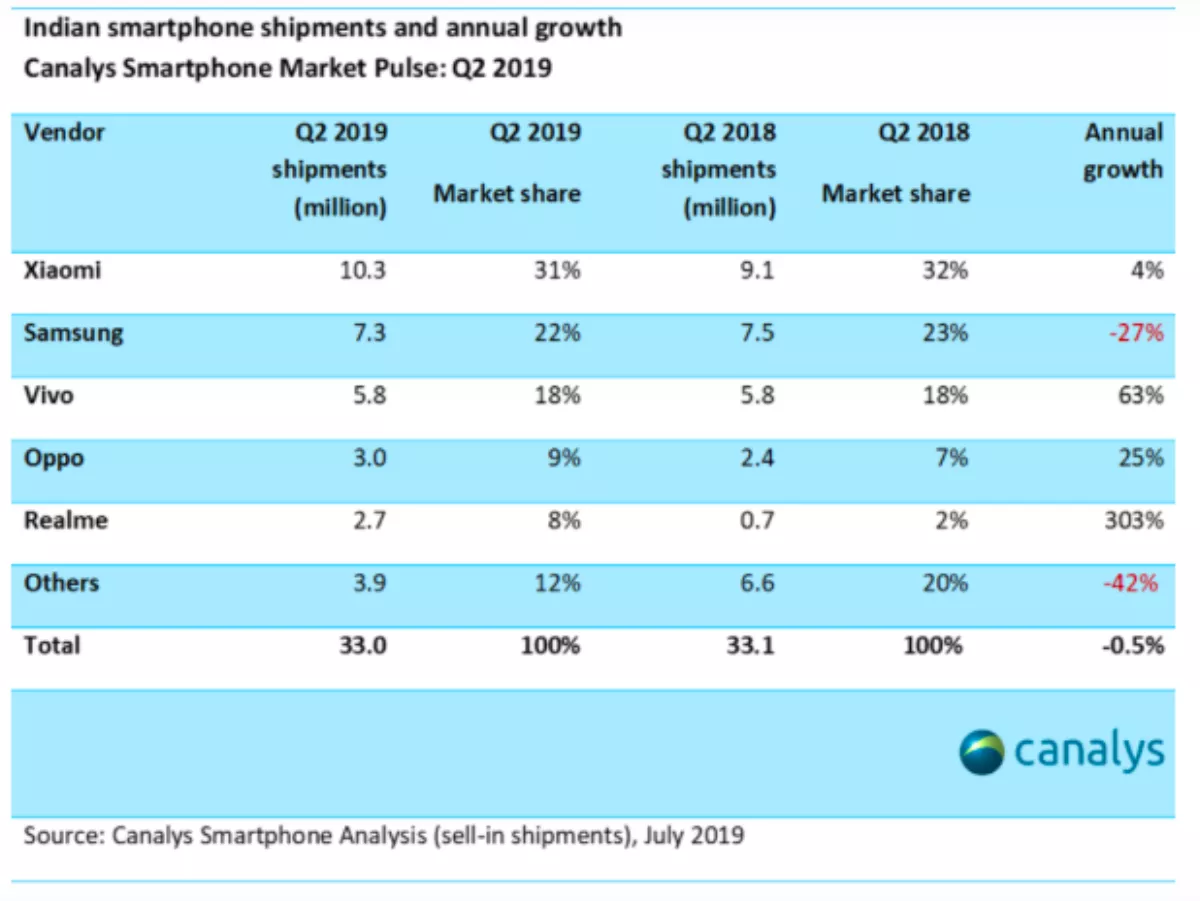

Vivo is enjoying a record-breaking the moment, shipping 5.8 million smartphones to India in quarter two of 2019, according to Canalys.

The Chinese smartphone maker has smashed its own record of 4.5 million units shipped.

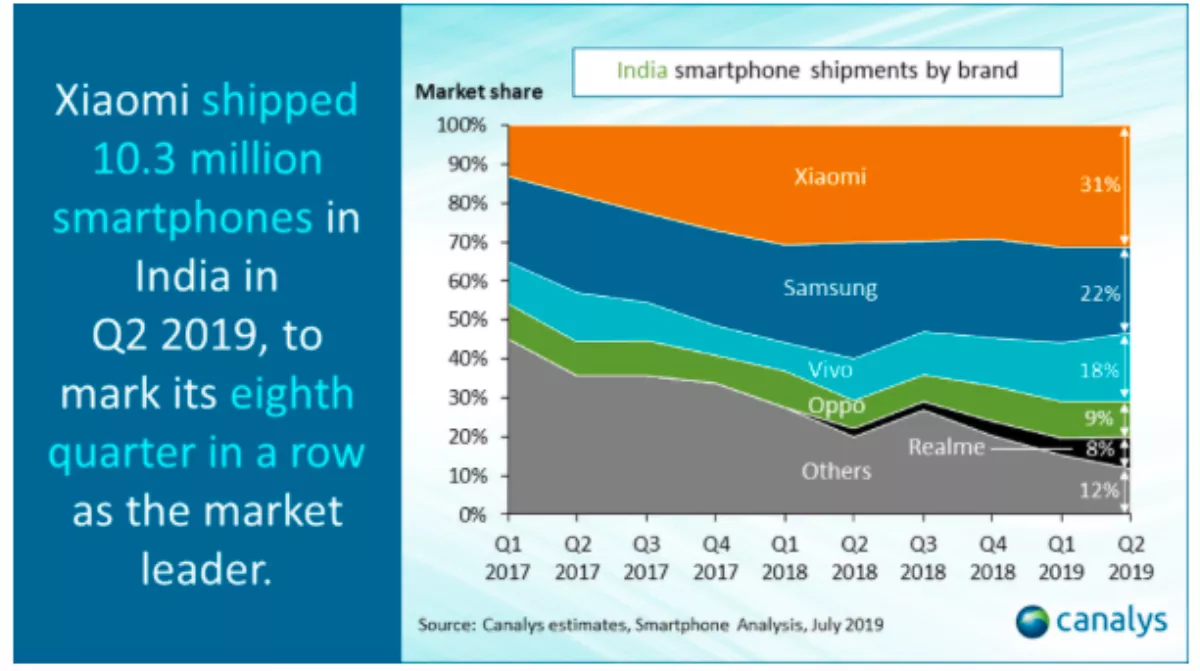

Its market share hit 18%, up from 10% a year ago and 15% in Q1 2019. Xiaomi, the Indian market leader, extended its reign to eight consecutive quarters as it shipped 10.3 million smartphones and achieved more than 30% share for the second quarter in a row. Second-placed Samsung, the only vendor in the top five that declined, saw shipments fall by 27% to 7.3 million units. Vivo was placed third, followed by Oppo and Realme, in fourth and fifth place respectively.

"Vivo's growth-stamina is commendable," says Canalys analyst Shengtao Jin.

"Its current trajectory would see it displace Samsung by the end of 2019, dealing a major blow to the Korean vendor. However, Samsung has now completed a disruptive portfolio refresh, which has positioned it to fight harder for share with tight margins," Jin explains.

Vivo focuses on the market for smartphones priced in the range of INR 10,000 to INR 15,000. Its top shipping smartphones this quarter were the Vivo Y17 and the Vivo Y91, which shipped over 1.5 million units in Q2 2019.

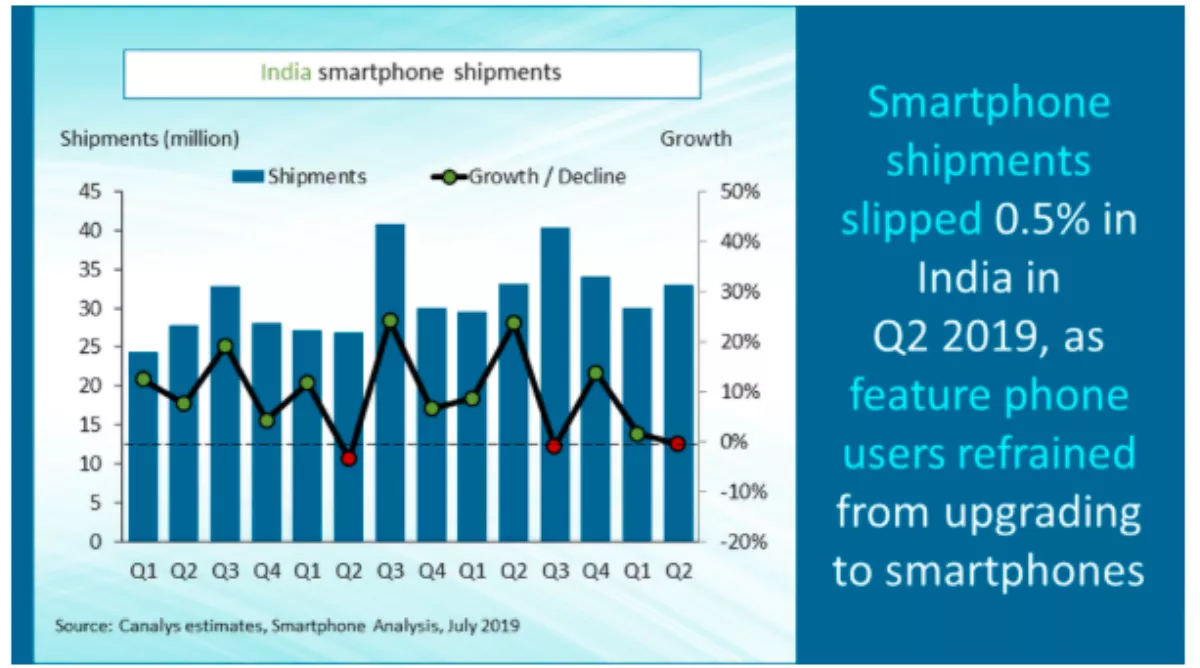

Canalys says Vivo's performance streak is particularly impressive against an overall smartphone market that declined slightly in India, to 33.0 million units.

Rushabh Doshi, research director at Canalys, says the decline in the market is not a cause of worry.

"However, the lack of growth is against the expectation of several major vendors," he says.

"Feature phone users are not taking to smartphones as quickly as the industry had expected and the bulk of growth in the Indian smartphone market is now coming from users who are upgrading their devices to a US$200 (~INR 15,000) or even a US$300 (~INR 20,000) smartphone," Doshi explains.

"India must now brace for further sluggish volume growth, as vendors stop focusing on sub-10,000 INR (~US$150) devices and move on to beef up 10,000 INR (~US$150) to 20,000 INR (~US$300) portfolios," he says. "However, the silver lining to this shift will be a brisk uptick in ASPs.

Doshi adds that the market continues to consolidate about the top five vendors. They accounted for 88% of the market this quarter, versus 80% a year ago.