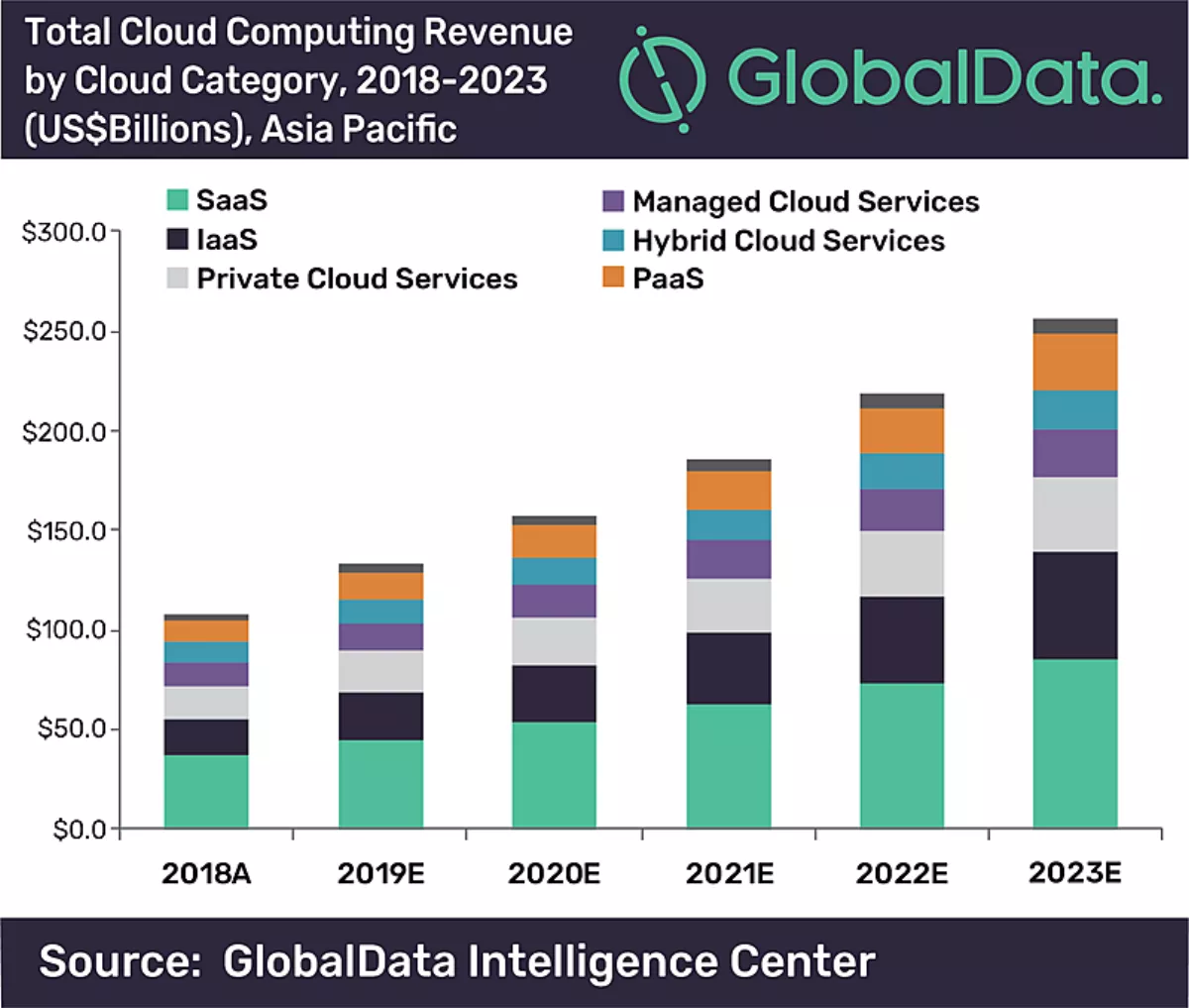

Hybrid cloud services to drive APAC enterprise cloud services revenue

Enterprise cloud services revenue is set to reach US$256bn by 2023 across the Asia Pacific region, according to new figures released by GlobalData.

An increase from US$107.6bn in 2018 and driven by hybrid cloud services, the figure represents a compound annual growth rate of 19%

GlobalData's latest report, Cloud Computing in Asia Pacific: Telco Cloud Offers, Best Practices and Market Opportunity, reveals that the market will continue to be led by software as a service (SaaS) offerings. However, growth rates from infrastructure as a service (IaaS) and platform as a service (PaaS) will exceed the growth from SaaS during the forecast period.

"In the cloud marketplace, SaaS has been widely adopted by enterprises looking to take advantage of the simplicity of service delivery and flexible pay-as-you go pricing that cloud delivered software offers," says Malcolm Rogers, senior technology analyst at GlobalData.

"Increasingly enterprises are also looking to build in agility to their IT infrastructure by moving proprietary software workloads and data storage off of on-site data centers to cloud providers, which will drive the growth in IaaS and PaaS space," he says.

According to the report, China and Japan are the dominant cloud markets within APAC with China accounting for 34% of the total APAC cloud market, followed by Japan with 25.5% in 2019.

China is home to cloud hyper-scale provider Alibaba Cloud while Japan has a mature ecosystem of cloud providers with a strong focus on the Japanese market.

"In order to grow their revenue from the cloud marketplace, telecom operators in APAC are increasingly beginning to offer cloud management platforms and integration services," says Rogers.

"Rather than competing with hyper-scale providers such as AWS, Microsoft Azure and Alicloud, telcos are bundling cloud services from multiple providers with connectivity and offering management tools through a single platform," he explains.

Rogers says that for operators, the managed services component and cloud optimised networks are increasingly important.

"Enterprise cloud environments are growing in complexity with most businesses using multiple public clouds as well as private cloud environments.

"The ability to manage various cloud environments with a single view while providing a high performance and dynamic network is the differentiator for operators in a competitive APAC cloud market," he says.

Emerging APAC markets in South East Asia are also increasingly targeted by the worlds largest cloud providers such as AWS, Microsoft Azure, Google Cloud and Alibaba, the report shows. Governments and enterprises around the region are increasing scrutiny around data sovereignty requirements, which has prompted the hyper-scale players to begin building out data centers in the region. Telecom providers in the region are responding to the changing dynamic in the region accordingly.

"Given the increasing competitiveness and market dominance from pure-cloud players such as AWS and service providers such as IBM and Microsoft in the IaaS market, telcos are expanding their reach in the enterprise cloud computing space by acting as integrators of multi-cloud platforms and providing consulting, implementation and management services," Rogers says.

"The cloud market is quite saturated with a number of providers, including webscale players, IT vendors and system integrators. Carriers can position their network advantage such as integrated cloud and network services or software-defined capabilities to differentiate in the market."