APAC business process outsourcing market set to grow

The business processing outsourcing market is set to grow across the Asia Pacific region between 2018 and 2034, according to new figures from GlobalData.

The data and analytics firm says Asia-Pacific is continuing to be a vibrant market in the BPO space, owing to the increasing number of contact centres in the region.

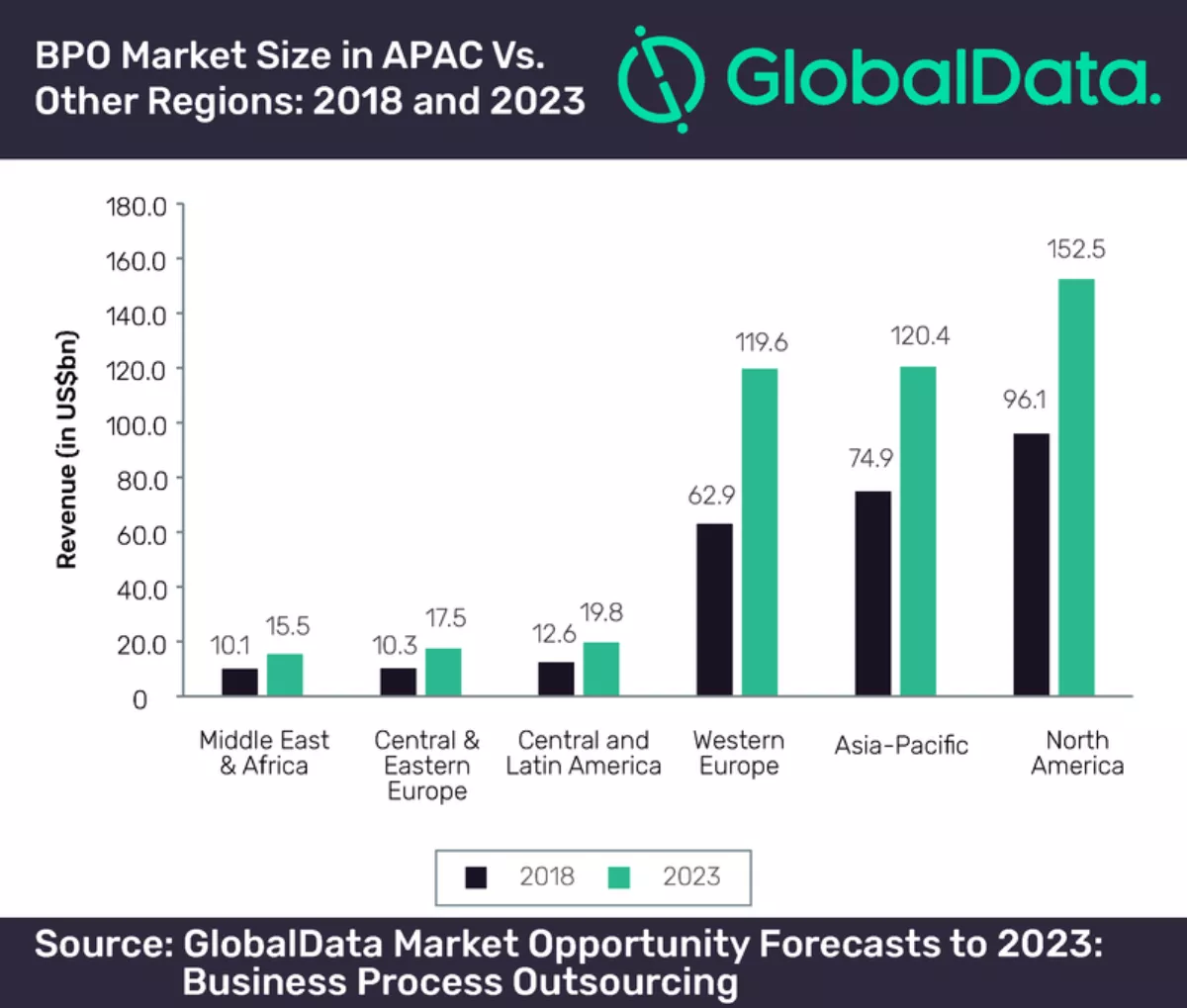

Against this backdrop, the overall BPO market in the region is estimated to grow at a compound annual growth rate (CAGR) of 10% between 2018 and 2023 to reach US$120.4 billion.

According to GlobalDatas Market Opportunity Forecasts Model, APAC is set to emerge as the second largest BPO market globally, behind North America (US$152.5bn).

"Outsourcing of specific functions or processes with a view to focus on cost-optimisation, enhancing flexibility to scale up as per business requirements and re-focusing on core business activities by large as well as specialist companies will be the key drivers of the BPO market in the APAC region," says Sunil Kumar Verma, lead ICT analyst at GlobalData.

China, Japan, India, Australia and South Korea will be the five largest BPO markets within the APAC region, accounting for more than 80% of the overall market share by 2023.

"This will be primarily be driven by the increasing number of global companies expanding their base in the region and partnering with agile business partners to provide them with the required services," says Verma.

The forecast says human resources BPO segment is set to grow at a CAGR of 15% during the forecast period and continue to be the largest segment with 32% share in the overall BPO market in the region.

"With increasing process standardisation, productivity gains due to digitalisation and workflow automation, the extent of outsourcing by enterprises might not be limited only to back office operations in the future," explains Verma.

"It will make inroads into the front-office and middle-office operations as well. Enterprises alongwith business partners might collaborate to establish mutual service centers such as Center of Excellence (CoE)," he says.

"However, security and privacy will continue be the major hindrance for such initiatives."