2019 PC market growth benefits big three vendors

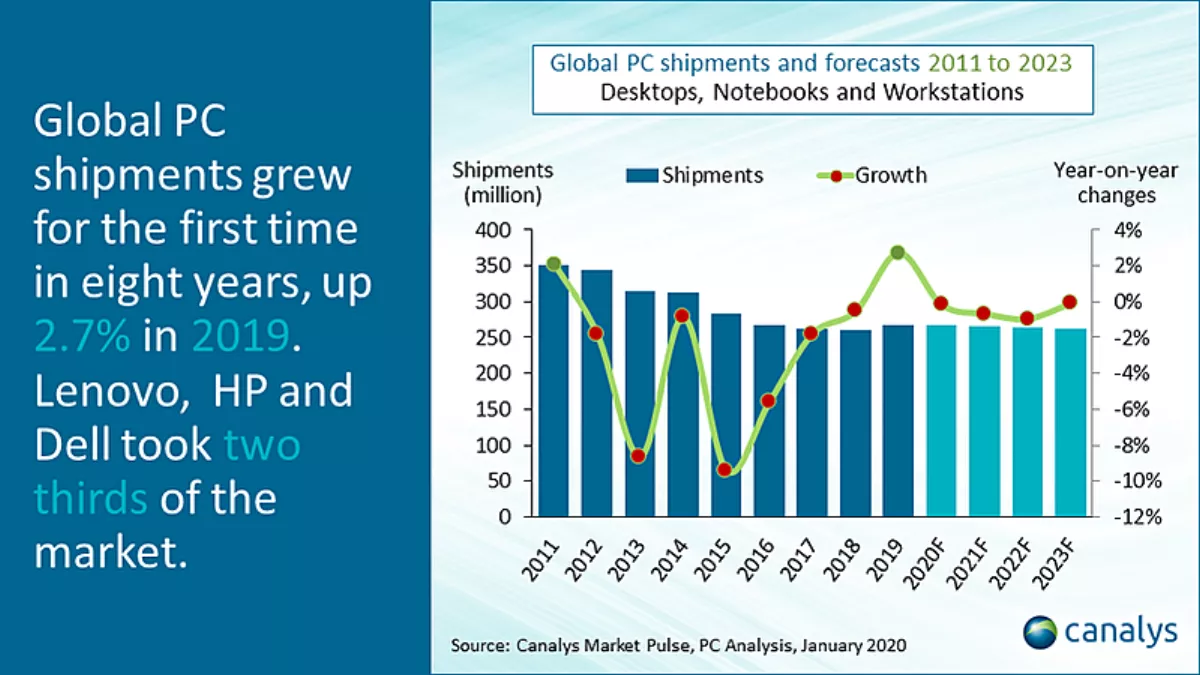

The global PC market recorded its first full year of growth in eight years in 2019 – inclusive of desktops, notebooks and workstations, 268.1 million units were shipped, up 2.7% on 2018.

However, the growth is focused on the largest three vendors which now account for two-thirds of all shipments.

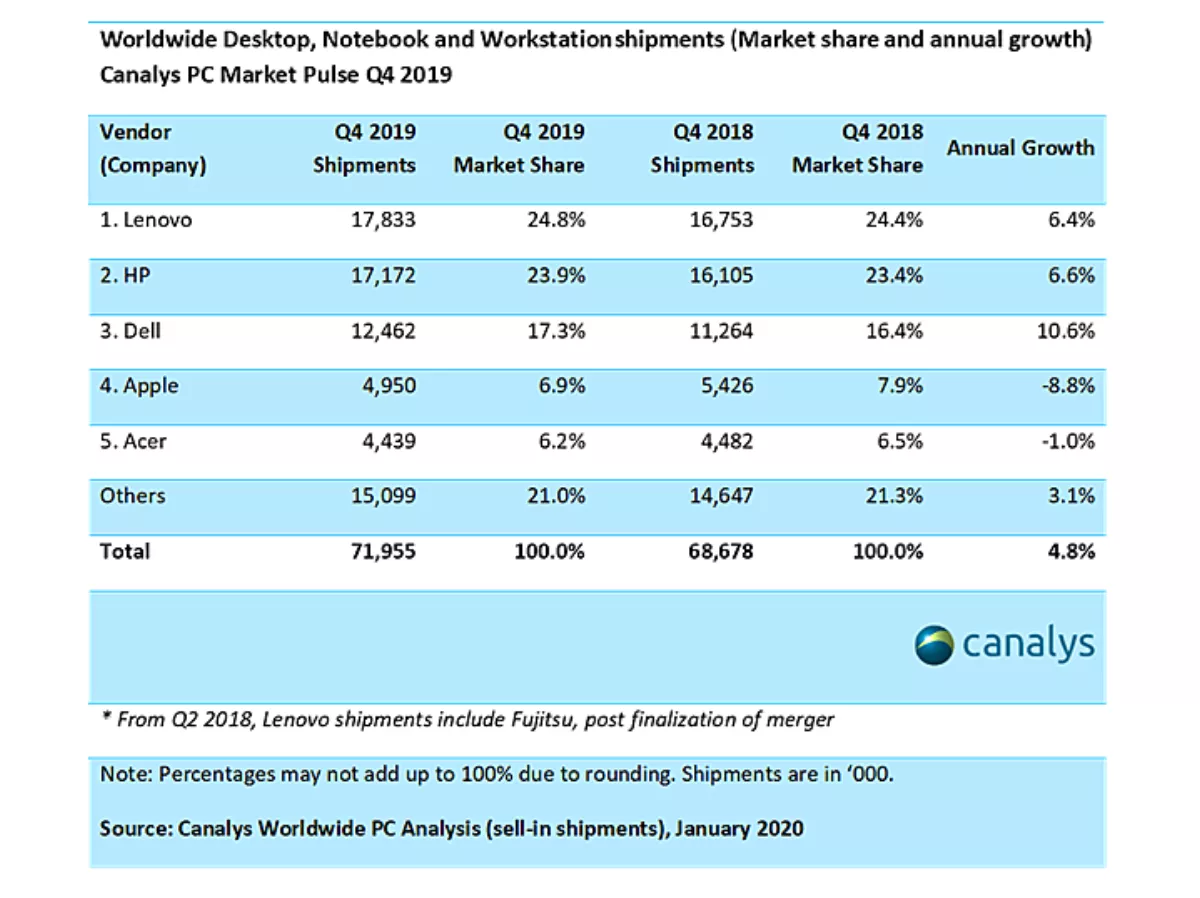

For the whole year, Lenovo leads with 64.8 million units shipped while HP trailed closely at 63.0 million, with 8.6% and 4.7% growth respectively.

Third-placed Dell also outpaced the market, with 5.3% growth, and shipped 46.5 million PCs.

Apple and Acer maintained fourth and fifth places, although Acer was the only vendor in the top five to decline from 2018.

IDC also noted the anomalous 2019 growth, highlighting that this is the first full year of PC growth since the market grew 1.7% in 2011.

According to IDC's report, the traditional PC market in APAC came in slightly above forecast with shipments expected to be flat year over year as hardware renewals related to Windows 10 migration and end-of-year budget spending combined to support commercial PC shipments.

"PCs had a decent holiday quarter," says Canalys analyst Ishan Dutt.

"This is impressive given the market registered record growth in Q3. Despite supply chain issues, vendors remain bullish, especially in commercial. Intel's continued efforts to improve supply will help maintain volume in 2020, but constraints are unlikely to ease quickly. The upshot, however, is the upgrade opportunities OEMs have with SMBs who have delayed refreshes in anticipation of new chipsets.

"2020 is unlikely to repeat the success of 2019," adds says Canalays research director Rushabh Doshi.

"Macroeconomic factors continue to influence the PC industry heavily, as key markets like the US, Japan and India are expected to underperform, for the major part of the year. Adding uncertainty to the market is a possible disruption to HP, which continues to be the target of a hostile takeover by Xerox.

"5G and foldable displays will bring some excitement to otherwise iterative upgrades. However, vendors remain in an experimental phase for both these features. Foldables suffer from a serious lack of use-cases, and demand is unlikely to grow unless second or third-generation devices can prove durability. 5G, on the other hand, needs ecosystem readiness from network operators and cloud providers to justify the value offering of these devices. Mainstream adoption of 5G and foldable displays is still a good two to three years away.